2020: The Year of Digital-Only Banking?

Revation Systems

JANUARY 15, 2020

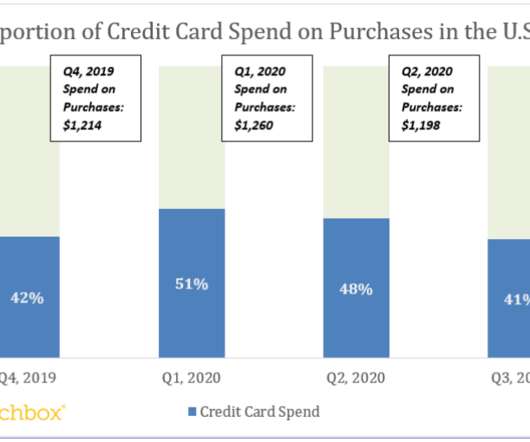

As technology continues to impact the banking industry today, a shift is beginning to occur in consumer behavior. This statistic is indicative of the sheer strength that digital banking has today – especially for the younger generations of consumers like Millennials and Gen Z. Digital Banking as One Piece of the Puzzle.

Let's personalize your content