Effective Bank Customer Retention Strategies

Genroe

JUNE 20, 2024

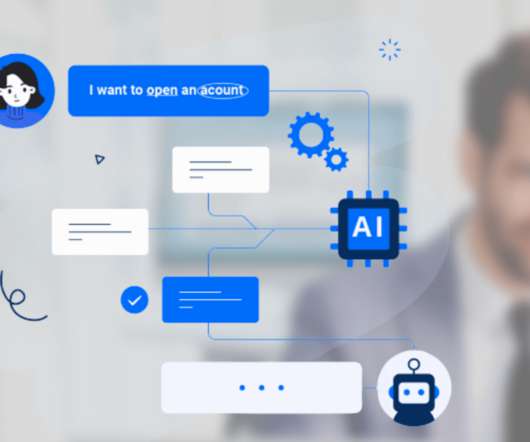

Discover effective bank customer retention strategies tailored to each stage of the customer life-cycle. Learn how to leverage customer feedback and personalization to keep your banking customers engaged, loyal, and satisfied. Explore the secrets of successful customer retention in the competitive world of banking.

Let's personalize your content