Personalization Strategies for Inbound and Outbound Banking Calls: A Technology Perspective

Hodusoft

JANUARY 24, 2024

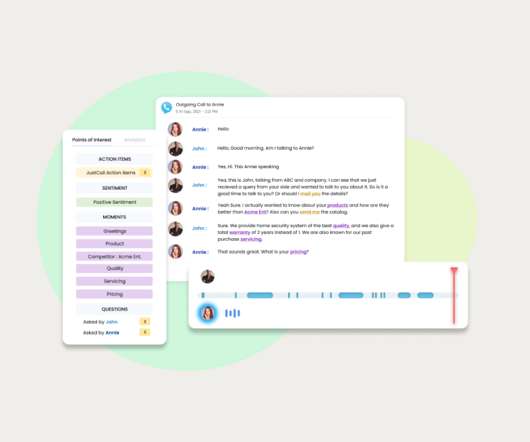

Personalization Strategies for Inbound and Outbound Banking Calls: A Technology Perspective Within the quickly changing banking industry, where the customer experience is paramount, the concept of tailored interactions has become increasingly important.

Let's personalize your content