How do UK banks rate on customer experience?

Eptica

MARCH 14, 2018

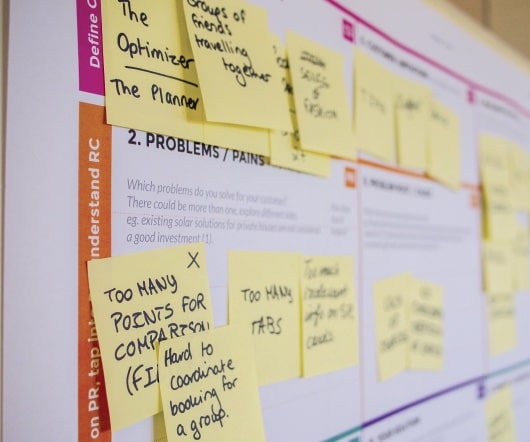

Date: Wednesday, March 14, 2018 How do UK banks rate on customer experience? Author: Neil Cox Banking, like many other sectors, is undergoing a period of disruption and change. They want an easy, transparent experience from brands that treat them well, value their time and reduce friction in all areas.

Let's personalize your content