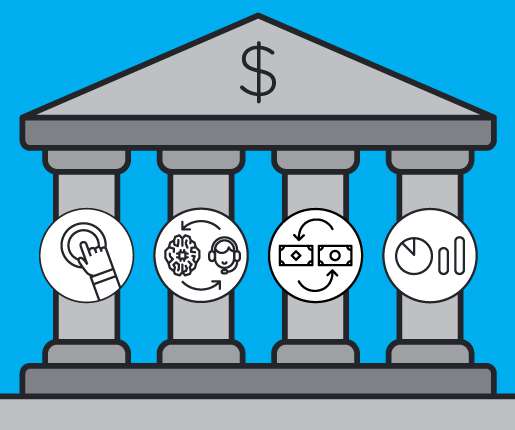

4 Ways Banks Can Hyper-Personalize Customer Experiences at Scale

SharpenCX

FEBRUARY 24, 2023

A study by Walker found that 80% of consumers expected personalized customer service from businesses across all sectors – and they’re willing to pay more for it, too. In today’s digital age, you can no longer afford NOT to provide personalized experiences for your customers. Banks and credit unions are no exception here.

Let's personalize your content