The Future of Customer Experience in Banking in 2023

Lumoa

SEPTEMBER 30, 2022

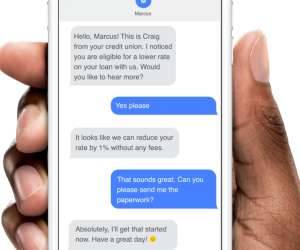

By now, the importance of delivering a superb customer experience in banking is crystal clear. Plus, their customers are also two times more likely to try new products or services. . Keeping up with the latest trends can help you understand the impact that these tendencies have on your banking customer experience.

Let's personalize your content