What is Graph Analysis For Fraud Detection?

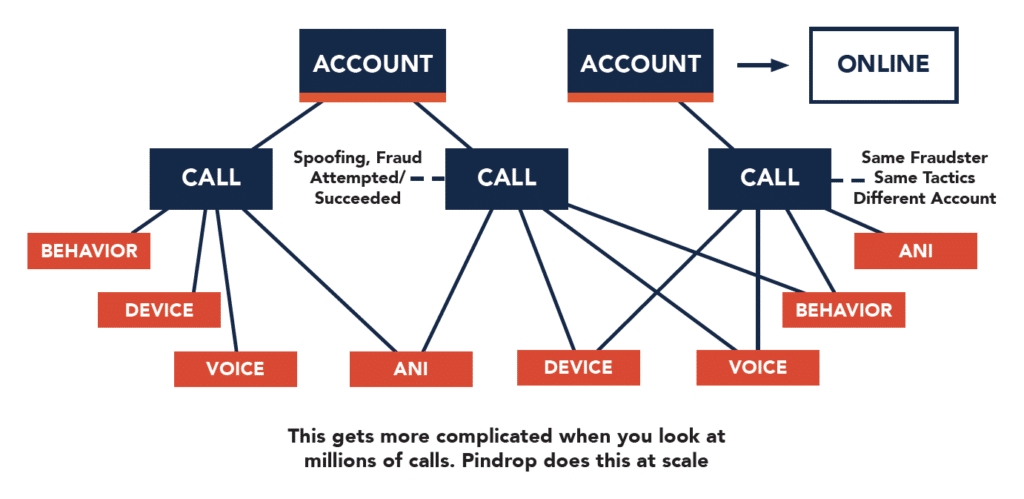

Graph analysis Is the process of analyzing data stored in graph format. Graphs are mathematical structures that represent relationships between various objects and when modeled are visualized with nodes and edges like the image above.

Nodes for the purpose of fraud detection would be the accounts, calls, transactions, and other data points- while edges would be the links, relationships, or connections between the nodes.

Without the popularized visualizations, graph analysis is still extremely useful for fraud detection. Legacy methods of data storage are not designed to analyze complex relationships between data points. Relationships can not be searched in a table and the “fixed schema” of tabular relational models and databases is not as flexible as graphs. Graph databases place the same value on relationships (edges) as it does data points (nodes) – making relationships discoverable. Thus graph analysis is not only the next evolutionary step in data storage and analysis but the next logical step in fraud detection, mitigation, and prevention.

What is Link Analysis?

When considering the application of graph analytics for fraud detection in call centers, operationally the “edges” or relationships, links, and connections associated to each node are analyzed to identify valuable patterns that can predict when and where fraud may occur. Link analysis is used to evaluate the connections between “nodes” or data points. These data points like accounts, calls, behaviors, devices, time, transactions, and phone numbers, as noted above, traditionally live in formats that make the discovery, modeling, and otherwise analysis of relationships simultaneously more complex and less useful.

What is Graph Analysis for Fraud Detection in Contact Centers?

Fraud detection for contact centers consists of the tools, software, and processes related to the detection of fraud entering or “touching” the contact center.

[optin-monster slug=”veowvgbyv2iwn47twt5u”]

Why is the Application of Graph Analysis For Fraud Detection in The Contact Center Important?

As the world adjusts to a contactless society, contact centers have been experiencing soaring call volumes as consumers replace face-to face interactions with voice-to-voice. With this surge has come rising fraud activities across channels; new and unprecedented challenges in ensuring customer satisfaction and security.

Though extremely valuable for uncovering patterns that indicate fraud across vast and seemingly unrelated datasets, graph analysis has been slow to reach the contact center until Pindrop Protect ® with Trace Technology.

What is Pindrop® Protect With Trace Technology?

Pindrop Trace technology is our patent-pending analytics engine that powers Protect’s account risk scoring. By measuring call risk over time and identifying what accounts are being accessed by those high risk calls is the first step in creating an account risk score. Other factors like online activity or failed login attempts can be added to increase the accuracy and predictive capability of account risk. Account risk scoring enables identification of the most complicated fraud scams, and predicting cross-channel fraud up to 60 days before it takes place.

Pindrop Trace technology uses graph analysis to process large sets of data across calls and accounts to identify complex patterns of call risk and account risk. enabling you to prevent more fraud, sooner, and reduce fraud losses.

Siloed data leaves unfound clues that could have been used to stop fraud before it happens. Connect all of your data with Pindrop Trace. This patent-pending analytics engine powers Protect’s account risk scoring, identifying the most complicated fraud scams, and predicting cross-channel fraud up to 60 days before it takes place.

Benefits of PindropⓇ Trace

- Get a complete picture of fraud across the company by connecting all of your data and stitching together sparse/disparate data that may indicate fraud is happening.

- Identify and prevent even the most complicated fraud scams up to 60 days in advance of fraud with account risk scores powered by Pindrop Trace.

- Improve analysis by adding your own additional data from other systems (weblogs etc.) into Pindrop Trace.

- Remove analyst noise, reduce false positives and improve false-negative detection

- Reduce overall fraud costs.

How Does Pindrop Protect With Trace Technology Work?

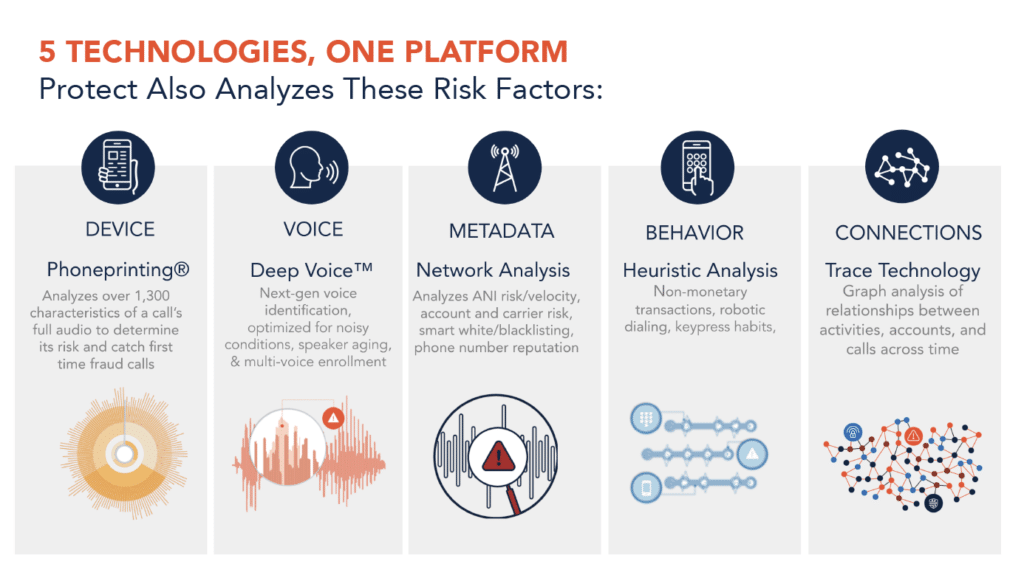

Pindrop Protect is the only anti-fraud solution that extends anti-fraud protection into the IVR using specially adapted non-audio technologies and graph analytics for contact center fraud detection.

Pindrop Trace® technology correlates account activities across calls and analyzes relationships between seemingly unrelated data points to identify patterns that indicate fraudulent activity and predict fraud loss.

Pindrop Trace® technology processes a comprehensive set of data inputs including detailed call and historical information, existing patented Pindrop risk engines, the extensive Pindrop Intelligence Network (PIN), and other enterprise data.

Why Pindrop Trace, Graph Analytics for Fraud Detection in the Contact Center

Pindrop Protect With Trace Technology connects all of your data, so you have the most comprehensive view of potentially fraudulent activity across all touchpoints, enabling you to prevent more fraud and reduce fraud losses.

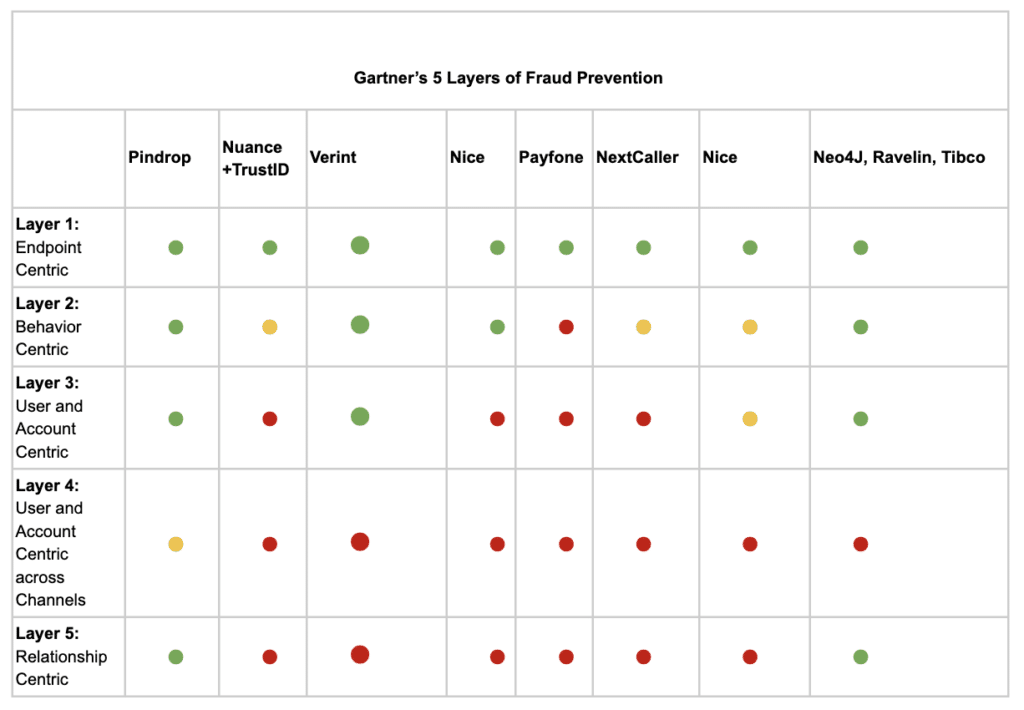

“No single layer of fraud prevention or authentication is enough to keep determined fraudsters out of enterprise systems.” – Gartner,The Five Layers of Fraud Prevention and Using Them to Beat Malware April 2011

Gartner Outlined 5 Layers of Fraud Prevention

Gartner recommends a 5 layered approach to fraud detection. The basic layer focuses on the user (caller, customer) while a more sophisticated approach focuses on the correlation between account and user in a cross-channel environment. Like Protect ® with Trace, according to Gartner, the most sophisticated approach uses a link analysis of relationships between “entities” or database elements to identify organized crime.

Pindrop’s closest competitor provides an IVR behavior and metadata tracking solution that correlates caller and account to alert for future monitoring. However, the competitor’s solution cannot extend across channels and does not include graph analytics.

TL;DR: Pindrop has just released Pindrop Protect with Trace technology the only anti-fraud solution that extends anti-fraud protection into the IVR using specially adapted non-audio technologies and graphic analysis for contact center fraud prediction.

To learn more about Trace technology and graph analysis for fraud detection in contact centers visit our solutions page.