Three Ways Call Centers Can Reduce Average Wait Time

JustCall

MAY 14, 2024

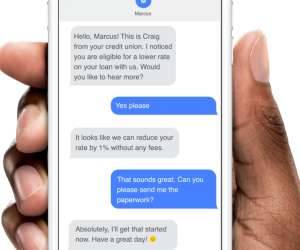

Higher average wait time (AWT) almost always leads to higher abandonment rates and lower CSAT scores. No one likes to wait more than a few minutes to connect with a support agent (unless there’s a grave issue that’s worth the wait). Let’s see how you can solve these challenges and reduce wait times.

Let's personalize your content