In recent years, we have had the pleasure of being immersed in the credit union industry. We’ve fielded comprehensive benchmarking surveys that cover contact center operations, metrics, technology, and resiliency. We’ve facilitated advisory group meetings and roundtables in which CU contact center leaders discuss significant accomplishments, challenges, and plans. And we’ve worked with many CUs to conduct assessments and develop roadmaps to address strategy, operations, organizational development, technology, and metrics as they grow and change.

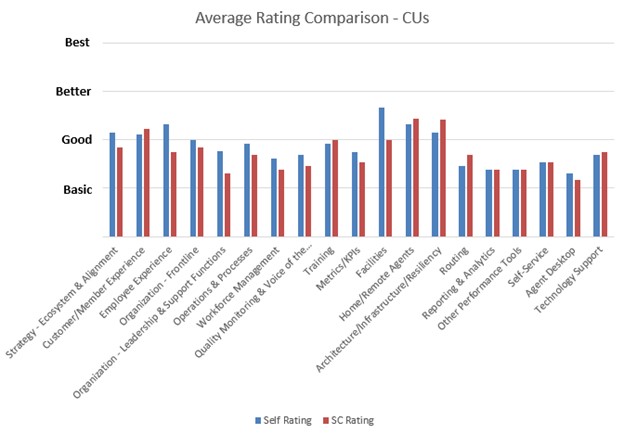

We use our proprietary Efficiency and Effectiveness Evolution (E3) Spectrums® tool to help contact centers assess how they are doing today and chart the path to a desired future state. The E3 defines maturity across four levels toward best practices: 1 – Basic, 2 – Good, 3 – Better, and 4 – Best. Using definitions for these four levels in each of 18 categories1, we rate the client, and clients rate themselves. We have used this tool with over 40 companies in the last four years, including more than a dozen credit unions.

Here’s how our ratings stack up with credit union contact center self-assessments:

A few observations are worth noting:

- Nearly every credit union touts their member experience as a key differentiator in a crowded financial services market. It is part of the credit union DNA! However, ratings land somewhere between Good and Better. We’d like to see it reach the Better or Best level routinely.

- The two highest self-ratings reflect a focus on staff – i.e., the employee experience and facilities. They’re also the categories with the largest gap between our ratings and the self-ratings, perhaps reflecting management’s good intentions rather than reality.

- Quality Monitoring, Workforce Management, metrics, reporting and analytics, performance tools, and the support roles to go with them all rate relatively low. These areas represent big opportunities for improvement as credit union contact centers mature. Investment in these areas would undoubtedly bump up the first three (and arguably most important, ratings) Strategy, Member Experience, and Employee Experience.

- Our outsider view aligns well with how credit unions rate their technology. In most categories, the ratings are between Basic and Good, reflecting fairly low maturity in credit union contact centers. With routing and the agent desktop so crucial for agent efficiency and the member experience, these areas merit particular attention.

- When we look at our CU clients versus others in wide-ranging industries, we see further emphasis of the opportunity for CUs to mature in the areas they lag the most: Support Functions, Metrics, and the Agent Desktop.

In discussions with contact center leadership, a common refrain is: “We don’t know what we don’t know.” It’s especially true of smaller centers. A careful assessment and planning process builds awareness, identifies priorities for short- and long-term planning, and builds the business case to secure executive level support and funding.

It’s exciting to see credit union contact centers grow and mature. There’s ample opportunity to make progress in key areas that will benefit the CU, the center, employees, and members.

1 Facilities ratings were part of Strategic Contact’s work prior to the pandemic. Home/Remote Agents replaced that rating when Covid sent many staff home. CUs continue to rate themselves in either or both categories, as appropriate.