Cloud gaming: demo deep dive

By Maru Entertainment & Technology | August 8, 2022

Maru has previously explored how the cloud gaming market is set for growth with this report a companion piece that dives deeper into differences between age groups.

That cloud gaming is poised for growth is hard to dispute. The emergence of stable high-speed broadband is the bedrock that the industry has been waiting for, with tech giants Google and Amazon vying with traditional gaming heavyweights Sony and Microsoft for consumer interest in the growing industry.

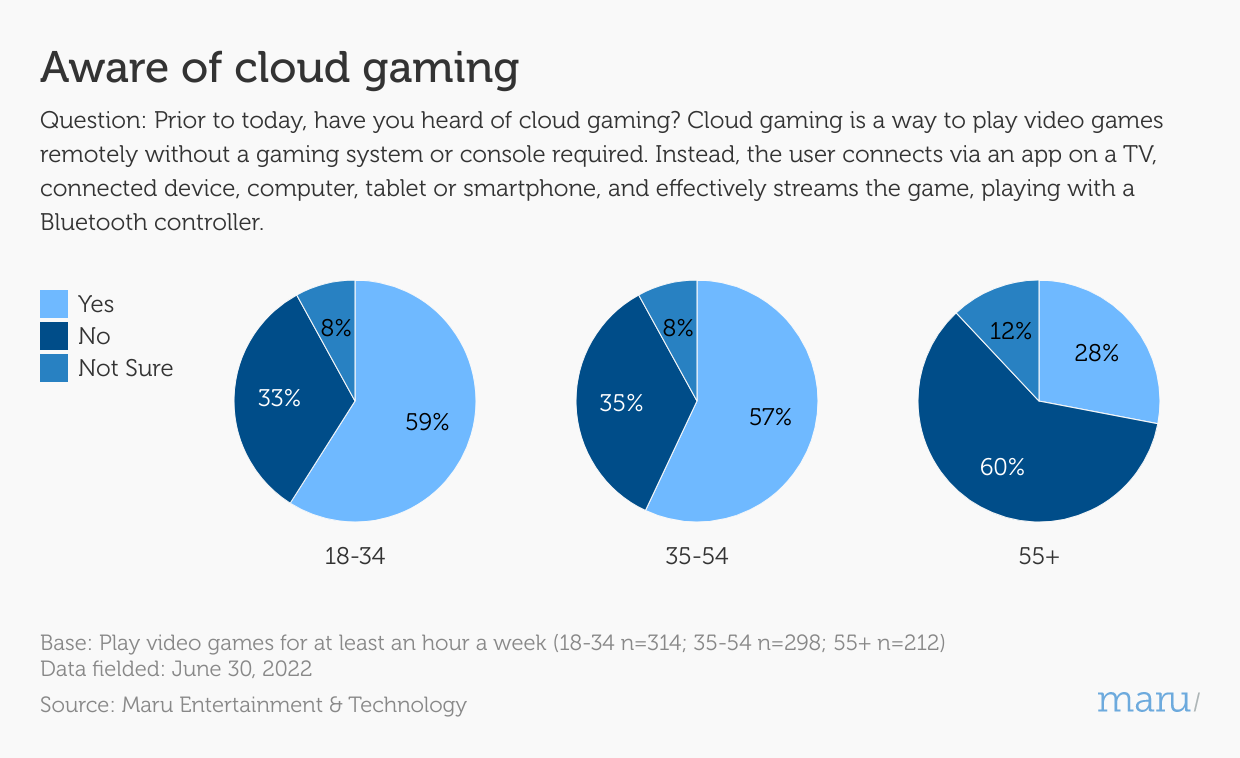

There’s no real difference between gamers 18-34s and 35-54s when it comes to awareness of cloud gaming, with close to 6 in 10 of each saying they knew about the concept prior to the survey. What is interesting is the decline in awareness among older gamers, who have a pre-existing awareness level around half that of the under 55s at around 3 in 10.

The older demo are also least likely to be interested in cloud gaming after being exposed to what it is, although gaming companies shouldn’t discount the 15% who are very interested in it. Overall interest levels are quite massive among younger gamers, with 78% of 18-34s and 66% of 35-54s expressing a top two box positive level of intrigue toward the concept.

With over one-third of 18-34 gamers very interested in cloud gaming if it was possible to do so via a TV set, and almost 3 in 10 of 35-54s, it would seem to be a license to print money to get new TV sets in front of these consumers.

A strategic move by a tech giant looking to gain traction in this field, especially one like Amazon who power a large number of smart TV sets in America, would be to ape what smartphones and tablets do and offer discounts to upgrade TVs to modern ones capable of cloud gaming. This would help grow the share of the cloud gaming market quickly, which would in turn see more overall pick-up among gamers as it becomes an established player in the market.

It’s worth noting that 18-34s are the demographic to most likely have made up their mind regarding if they would prefer to buy a console or stream games, with this the strongest group for buying a console. This is perhaps surprising, given that this is the generation of digital natives, but it suggests that cloud gaming will not supplant consoles but, more likely, run alongside them.

One factor behind this continued embrace of consoles is the fear of gameplay lags that cloud gaming may have. Half of 18-34s perceive this to be a downside of cloud gaming, versus one third of older gamers. Whilst perception of lags drops with each older demographic group, one aspect that they all agree on to a similar degree is how cloud gaming services may lack the games that they want to play.

Given that there are already over ten cloud gaming services in existence, it’s very feasible that each one will have unique gaming libraries, with PlayStation and Xbox seeing their in-house franchises locked to their own services. This will see a large proportion of the cloud gaming audience having either multiple service subscriptions at once, or high levels of churn within the industry.

If you are interested in exploring how Maru could help your business, please contact us today.