Leveraging Advanced Call Center Software- Enhancing FCR in Banks and Financial Institutions

Witness the evolution of the banking and financial landscape as it progresses into a new era of customer service excellence, driven by cutting-edge technology and real-time statistical insights. In today’s highly competitive business world, the demand for flawless customer support has stimulated transformative advancements.

In this blog, we delve into a field of banking and financial industry that has rapidly advanced with the use of advanced call center software solutions. It will help you gain insights into how banks and financial institutions can enhance their FCR rate with the help of cutting-edge call center software solutions.

As we embark on this insightful journey, consider the remarkable advances witnessed within the preceding year alone—an impressive 25% improvement in First Call Resolution (FCR) across major financial institutions. A seamless blend of technological innovations with human interaction reveals the intricacies of challenges and opportunities faced by financial enterprises. This data provides a guiding light for strategic decisions in an ever-changing financial landscape for smart business leaders.

- Understanding the Significance of First Call Resolution (FCR)

- FCR- Definition and Metrics

- The Impact of FCR on Customer Satisfaction

- Challenges in Enhancing First Call Resolution for Banks and Financial Institutions

- An Overview of Call Center Software

- Key Features and Capabilities of Call Center Software

- Integration of Call Center Software in Banking and Financial Sector

- Maximizing Technological Efficiency through First Call Resolution Excellence

- Real-world Examples of Banks and Financial Institutions Elevating FCR with Call Center Software

Understanding the Significance of First Call Resolution (FCR)

The First Call Resolution (FCR) is an essential part of an organization’s customer service strategy, representing its commitment to quick issue resolution and optimal customer satisfaction. Using real-time data, key metrics, and insights from industry leaders, let’s break down the multifaceted aspects of FCR.

FCR- Definition and Metrics

The FCR is the gold standard that measures how well a service center addresses and resolves queries or issues raised by its customers as soon as they contact it. It is widely used as the benchmark for gauging customer service efficiency.

As per various studies, the industry standard for a good first call resolution rate is between 70 to 75%. A higher FCR signifies effective resolution of issues and minimizes the necessity for follow-up calls.

The Impact of FCR on Customer Satisfaction

Customer satisfaction is the ultimate goal of any business, and FCR plays a pivotal role in shaping it. An important call center metric, FCR helps in resolving customer issues successfully resolved on the first contact.

When customers’ issues are resolved quickly and effectively, it creates a positive perception of the company’s commitment to customer service. After all, high FCR rates serve as a powerful indicator of well-functioning customer support operations, boosting customer experiences.

Additionally, positive experiences lead to long-lasting customer relationships as satisfied customers are more likely to return and recommend the company to others. On the other hand, companies with a low FCR rate, may experience customer frustration and dissatisfaction.

Therefore, businesses that focus on enhancing FCR not only increase customer satisfaction, but they also establish themselves as industry leaders in customer-centric practices, gaining a competitive advantage in the marketplace.

Now that we have explored the introduction and significance of first call resolution, let us delve into the intricacies of the challenges encountered by banks and financial institutions in their efforts to enhance first call resolution.

Challenges in Enhancing First Call Resolution for Banks and Financial Institutions

The banks and financial institutions face numerous challenges as they strive to improve First Call Resolution. These challenges occur largely due to the complex nature of financial queries and the necessity to provide outstanding customer service. Besides, these institutions also have to keep themselves updated with the ever-changing technology and cybersecurity landscape.

A call center software can play an important role in overcoming these challenges and improving FCR. Here are some challenges and the ways call center software can help:

Complex Inquiries

Banks and financial institutions often deal with complicated customer queries that require in-depth knowledge and expertise.

Call center software equipped with advanced features like skill-based routing, ensures that calls are routed to the most appropriate agents with the necessary expertise, increasing the chances of first call resolution.

Omnichannel Support

Today’s customers expect to communicate with the customer support team via different channels such as, phone calls, emails, live chats, social media channels, etc. This may complicate the FCR efforts made by customer support agents.

Omnichannel call center software merges different communication channels into a unified platform, allowing agents to access a customer’s interaction history across channels. This provides a more holistic view, leading to prompt issue resolution.

High Call Volume

Banks and Financial companies generally experience high call volumes, resulting in longer wait times and potential frustration among customers.

Call center software with features like Que Pro, interactive voice response (IVR), and skill-based routing ensures that calls are distributed efficiently, minimizing wait times. This may also contribute to increased FCR rates.

Performance Monitoring and Analytics

It would be difficult for banks and financial companies and any other organization to identify bottlenecks and areas for improvement in FCR without the help of real-time monitoring and analysis.

Call center software comes equipped with robust analytics and reporting features that allow users to track FCR rates, analyze call data, identify trends, and other important metrics.

Data Security and Compliance

It is mandatory for banks and financial institutions to adhere to strict data security and compliance regulations, which adds an extra layer of intricacy to customer interactions.

Call center software designed keeping in mind the data security and compliance requirements of the banks and financial sector, ensure secure handling of customer information and better compliance with industry regulations. For instance, many call center software these days incorporate security measures such as STIR/SHAKEN, encryption and secure data storage, etc.

It would be correct to say that an advanced call center software offers cutting-edge solutions that not only improves First Call Resolution but also sets the stage for a future where seamless, secure, and technologically advanced interactions define the customer experience.

An Overview of Call Center Software

In the dynamic landscape of customer service operations, call center software stands as the indispensable backbone, facilitating seamless communication between businesses and clients.

This comprehensive suite of tools, encompassing features like automated call distribution, interactive voice response, and robust analytics, is dedicated to enhancing operational efficiency.

Notably, the recent evolution of the call center landscape reflects a pronounced shift towards cloud-based solutions, ushering in a new era marked by scalability and flexibility.

Key Features and Capabilities of Call Center Software

As we delve into the key features and capabilities of contemporary call center software, it becomes evident that it transcends traditional functionalities.

The emphasis is on real-time data analytics, providing agents with invaluable insights that optimize decision-making during customer interactions. Innovative features such as sentiment analysis and speech recognition are instrumental in elevating customer engagement, resulting in higher satisfaction rates.

Moreover, seamless integration with CRM systems ensures a fluid exchange of information, empowering agents to deliver personalized and efficient services.

Integration of Call Center Software in Banking and Financial Sector

In the specific context of the banking sector, the integration of call center software takes on heightened significance.

For instance, real-time data on customer interactions emerges as a crucial tool, enabling tailored services that align precisely with individual needs. Also, advanced security measures help in addressing the stringent requirements of the banking and financial industry.

This integration with banking operations is pivotal, ensuring a unified customer experience where inquiries are addressed promptly and solutions are delivered with efficiency, ultimately contributing to enhanced overall customer satisfaction.

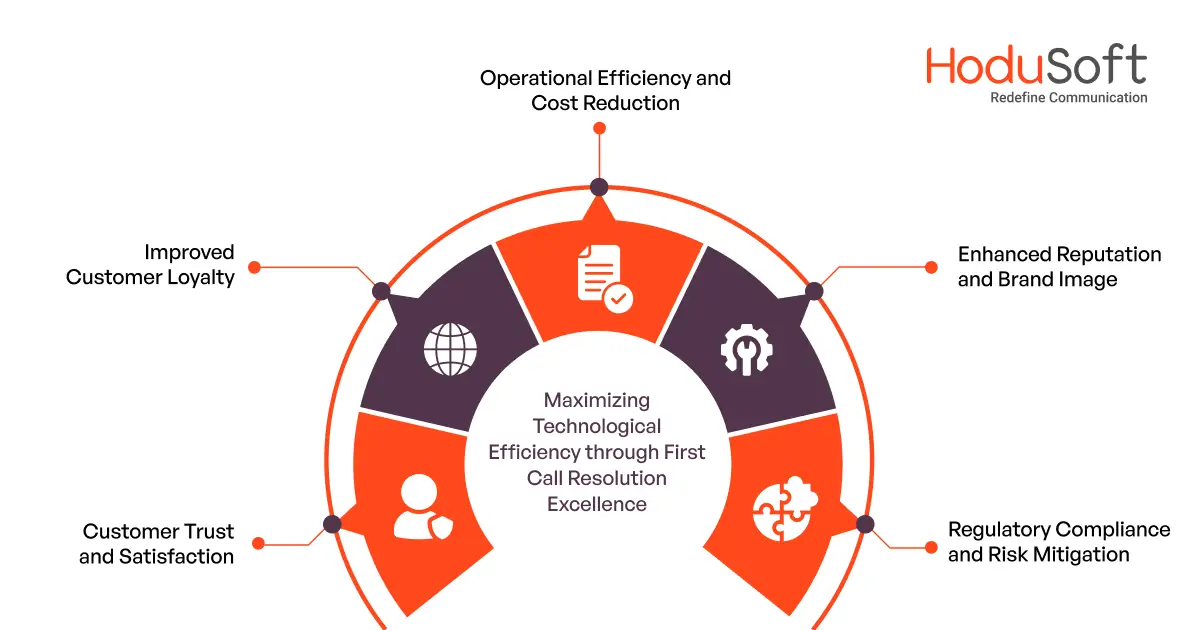

Maximizing Technological Efficiency through First Call Resolution Excellence

Achieving a high first call resolution rate yields multifaceted advantages for businesses and their customers. This efficient approach directly contributes to increased customer satisfaction, loyalty, and operational efficiency.

Customer Trust and Satisfaction:

Achieving a high first call resolution instills trust and satisfaction among banking and financial customers. Timely issue resolution during the initial contact demonstrates a commitment to customer needs, enhancing overall satisfaction and fostering long-term trust.

Improved Customer Loyalty:

The banking and financial sectors heavily rely on customer loyalty. High first call resolution rates contribute to enhanced customer loyalty as clients appreciate efficient and effective problem-solving, reinforcing their commitment to the financial institution.

Operational Efficiency and Cost Reduction:

Streamlining customer interactions with a high first call resolution rate leads to operational efficiency. Reduced follow-up calls not only optimize resources but also result in cost savings, allowing financial institutions to allocate resources more strategically.

Enhanced Reputation and Brand Image:

Consistently resolving customer issues on the first call contributes to a positive brand image. In the competitive financial landscape, a reputation for efficient customer service becomes a valuable asset, attracting new customers and retaining existing ones.

Regulatory Compliance and Risk Mitigation:

The banking and financial sectors operate within strict regulatory frameworks. Resolving customer issues promptly ensures compliance with regulatory standards and mitigates potential risks associated with unresolved concerns, safeguarding the institution’s reputation and financial standing.

Real-world Examples of Banks and Financial Institutions Elevating FCR with Call Center Software

Discover how leading financial entities leverage advanced call center software to redefine customer service and boost first call resolution.

1. JPMorgan Chase:

JPMorgan Chase has seamlessly integrated advanced call center software to streamline customer interactions. The implementation has significantly enhanced their FCR, showcasing the institution’s commitment to providing efficient and prompt issue resolution, thereby strengthening customer relationships.

2. Wells Fargo:

Wells Fargo stands out as a prime example of leveraging call center software to optimize FCR. Their strategic adoption of technology has not only improved customer satisfaction but has also streamlined operational processes, showcasing the transformative impact of tech-driven solutions.

3. Citibank:

Citibank has successfully incorporated call center software to elevate FCR, setting industry standards for efficient customer issue resolution. This implementation reflects Citibank’s dedication to delivering a seamless and responsive customer experience, reinforcing their position as a leader in the financial sector.

Revolutionizing their customer service game, these three industry leaders harnessed the potential of cutting-edge Call Center Software to boost FCR.

Wrapping Up-

Summarizing the impact of Call Center Software on FCR, this technology has been a game-changer in the banking and financial sector. Elevating First Call Resolution (FCR), it enhances customer satisfaction, fosters loyalty, and optimizes operational efficiency.

Encouraging banks and financial institutions to embrace technology is paramount for staying at the forefront of customer service excellence. HoduSoft takes the lead in delivering Call Center Software solutions, revolutionizing business communication. Our dedicated team, focusing on UC solutions, has redefined industry standards.

Ready to replicate their success? Connect with us!

Wrapping Up-

Summarizing the impact of Call Center Software on FCR, this technology has been a game-changer in the banking and financial sector. Elevating First Call Resolution (FCR), it enhances customer satisfaction, fosters loyalty, and optimizes operational efficiency.

Encouraging banks and financial institutions to embrace technology is paramount for staying at the forefront of customer service excellence. HoduSoft takes the lead in delivering Call Center Software solutions, revolutionizing business communication. Our dedicated team, focusing on UC solutions, has redefined industry standards.