How are banks meeting changing customer service needs?

Eptica

APRIL 11, 2022

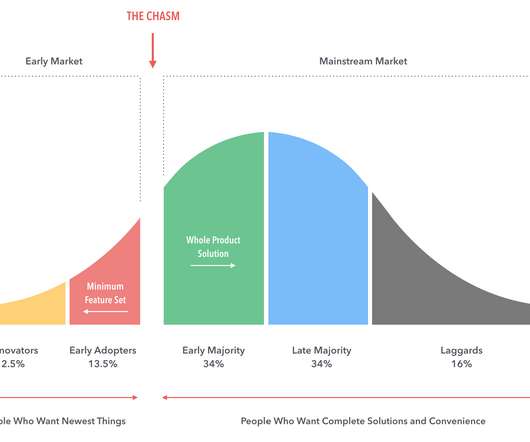

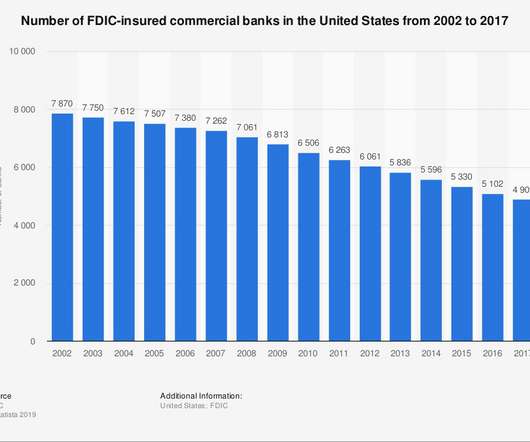

Date: Monday, April 11, 2022 Author: Pauline Ashenden - Demand Generation Manager How are banks meeting changing customer service needs? Companies need to meet the requirements of multiple demographics and deliver reassurance across multiple channels. How are banks and other financial services businesses responding?

Let's personalize your content