At A Fork In the Road: As a Customer Relationship Driver, Where Is Branch Banking Headed?

Beyond Philosophy

MARCH 31, 2015

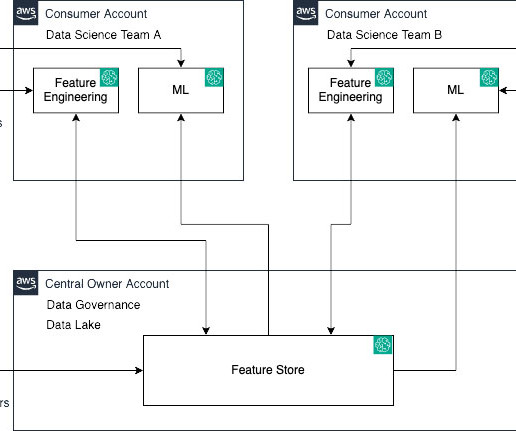

Both quotes seem to apply to what is currently transpiring with retail branch banking, and where it seems to be trending. Banks can’t quite make up their minds about what branches are supposed to be. The largest banks appear to be all about building branch relationships through technology. Are they both? Are they neither?

Let's personalize your content