Top 5 Business Phone Systems for Banking and Finance

Hodusoft

FEBRUARY 1, 2023

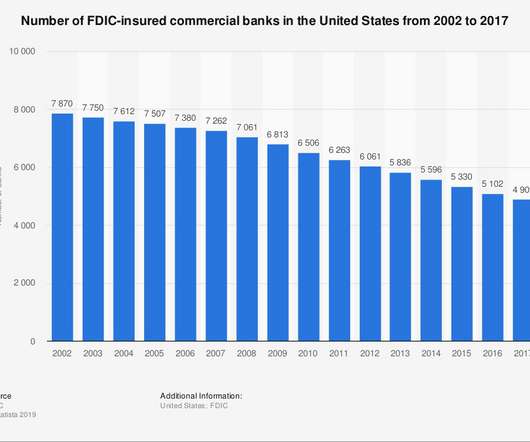

Accelerating Banking Success: The Top Business Phone Systems to Consider The banking industry is constantly evolving and adapting to the ever-changing technological landscape. One of the areas where this evolution is most evident is in the way banks communicate with their customers. What is a banking phone system?

Let's personalize your content