With the passing of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Friday, $360 billion in funds have been allocated to various federally funded loan/grant programs. The two most important programs for small business owners to pay attention to are:

- Economic Injury Disaster Loans (EIDL) and Emergency Economic Injury Grants (EEIG). $10 billion in funding with $10k grants available 3 days after application

- Payroll Protection Program. $350 billion in forgivable loans based on 2.5x payroll

Today’s post will focus on the Economic Injury Disaster Loan (EIDL) and the accompanying Emergency Economic Injury Grant (EEIG). While we’re not lawyers or financial advisors, Fivestars has summarized some of the most important questions for small business owners to think about below.

What is an Economic Injury Disaster Loan (EIDL)?

The US Small Business Administration (SBA)’s Economic Injury Disaster Loan (EIDL) program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to help overcome the temporary loss of revenue they are experiencing through disasters like COVID-19.

What are the terms of the Economic Injury Disaster Loans (EIDLs)?

- Businesses can borrow up to $2 million

- 3.75% interest for small businesses

- No loan fees, guarantee fees, or pre-payment fees

- Max term is 30 years

- If loan size <$200k, no personal guarantee needed (because of the CARES Act)

What is the Emergency Economic Injury Grant (EEIG)?

- The CARES Act allocates $10 billion in funding towards this grant

- Provides advance of $10,000 to small businesses that apply for an SBA Economic Injury Disaster Loan (EIDL)

- The SBA will provide grants within 3 days of receiving the Economic Injury Disaster Loan (EIDL) application

- The EEIG does not need to be repaid, even if the grantee is subsequently denied an EIDL

- Emergency Economic Injury Grant (EEIG) may be used to provide paid sick leave to employees, maintain payroll, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent, and mortgage payments

Who is eligible for an Economic Injury Disaster Loan (EIDL) and Emergency Economic Injury Grant (EEIG)?

Put simply, if your company has fewer than 500 employees and your business was operating as of 1/31/2020, you are very likely eligible to apply for both an EIDL and an EEIG.

If you’re in the hospitality or food service industries and you have more than 500 employees total, but no more than 500 employees at each individual location, you may still be eligible.

How do I apply for EIDL and EEIG?

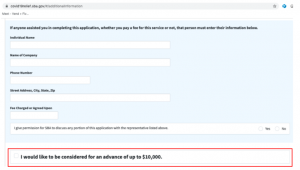

This past weekend, the US Small Business Administration (SBA) released an updated online application for Economic Injury Disaster Loans (EIDLs):

As part of the EIDL application process, business owners can also apply for the Emergency Economic Injury Grant (EEIG) by checking the “I would like to be considered for an advance of up to $10,000” check box.

If you have additional questions about the EIDL and EEIG programs, you can:

- Contact your local SBA District Office

- Call the SBA at 1-800-659-2955 (Warning: the wait time was over 2.5 hours yesterday, March 30, 2020)

- Email the SBA at disastercustomerservice@sba.gov

Actions to take:

- Work with your lawyer or financial advisor to determine if the EIDL or EEIG is a fit for your business

- While we’re not lawyers or in the business of giving financial advice, we highly encourage all businesses who have suffered from the coronavirus situation to submit an application

- Even if you’re not approved for the loan, and even if you don’t accept the loan, the $10,000 grant will be yours to keep so long as you meet basic eligibility requirements

- If the EIDL and EEIG options are right for your business, apply directly on the SBA website

The information provided is for informational purposes only. Fivestars is not providing legal or financial advice, or advice on how to apply, or as to eligibility, for available programs. Should you need legal advice, you should consult your own counsel.

Leave a Comment