Table of Contents

What is Digital Transformation and what’s driving it?

The contact center of the future is already here. Contact centers have been constantly transforming and reinventing themselves with a focus on improving customer experience. Growing call volume, greater competition for customer retention, and pressure to increase revenue have all contributed to contact centers becoming the focal point of customer interactions. These trends have driven contact centers to invest in capacity increase, workflow automation, and process improvements.

Then Covid-19 happened and everything changed. Due to the unique circumstances created by Covid’s impact on everyday lives, customers changed their behavior, which in turn affected how business centers and contact centers were expected to serve their needs. Call volumes spiked and call wait times lengthened as frustrated customers searched for a better way to engage with businesses.

Digital channels became more important and prevalent as a way for customers to reach out to businesses. However, call centers soon discovered that treating digital channels as standalone pathways was not the best approach. It hurt customer experience and also negatively impacted the ability of agents to cost-effectively serve customer needs. Therefore contact centers started evolving to not only provide a seamless pathway to customers across multiple channels but also to integrate the infrastructure, processes, and workflows internally to better facilitate this cross-channel engagement. This led to the digital transformation of the contact centers that seek to transform a legacy, inside-out contact center into a customer-centric, omnichannel, cloud-based business center that is optimized to deliver a positive customer experience, increase revenue and improve operational efficiency.

The How and the Why of Digital Transformation

Technology of Digital Transformation

Improve AX - Agent-Oriented Elements

- Process Automation – Intelligent call routing, intelligent scripting and unification of desktop across applications to improve agent efficiency.

- Goal: Leverage AI, smart workflow management tools and analytics to unburden agents.

- Workforce Management – Automation and enhancement of workflow optimization, agent coaching, performance management tools to expedite agent productivity and efficiency.

- Goal: Leveraging data, analytics and AI to automate and optimize agent training and onboarding processes

- Analytics – Interaction analytics, real-time decisioning and business intelligence for superior agent performance.

- Goal: Connecting data from data silos to help agents acquire actionable insights to navigate complex customer service issues

Improve CX - Customer Oriented Elements

- Case Management – Customer problem resolution, case management, knowledge management for delivering value to customers.

- Goal: Leverage business intelligence and real-time case management capabilities to enable faster response and increase customer satisfaction

- Customer Service – Omnichannel customer touchpoints (chatbots, email, video, voice, IVR, SMS), self-service, alerts that form the core of customer interactions.

- Goal: Optimize machine learning, deep neural networks, speech recognition technologies and cloud-based infrastructure to optimize the customer experience across channels

- Analytics – Business intelligence and modeling that offers insights into customer behavior, preferences and identity.

- Goal: Leverage insights data to offer more personalization and faster resolution for superior customer experience

Core Contact Center Infrastructure

- Transformation of legacy infrastructure to cloud including intelligent voice routing, IVR, and call recording applications.

- Goal: Enable a common, flexible and cost-effective infrastructure to enable seamless and asynchronous customer service across channels

Business Drivers of Digital Transformation

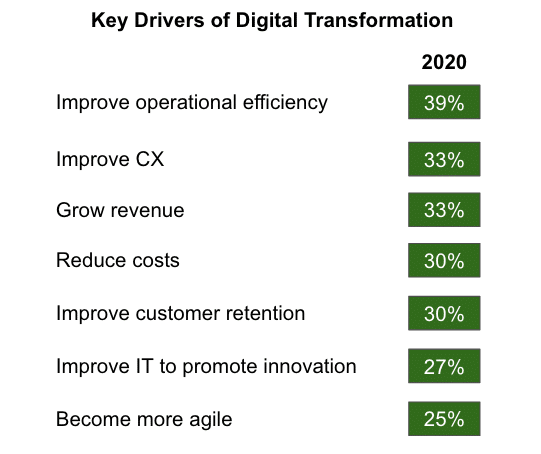

Forrester’s survey indicates that although CX is one of the top drivers for digital transformation in financial services, operational efficiency has now become the most important driver. Revenue growth and reducing costs continue to be crucial as well.

Forrester’s survey indicates that although CX is one of the top drivers for digital transformation in financial services, operational efficiency has now become the most important driver. Revenue growth and reducing costs continue to be crucial as well.

Thus, digital transformation is a very complex, comprehensive, and important technology strategy with multiple, interconnected moving parts. In addition, this transformation strategy needs to be carefully calibrated to provide superior CX, security, data, and efficiency to organizations that can lead to increased revenue and reduced costs. Digital transformation is a key piece of a call center’s forward-looking strategy that could help with customer retention, engagement, and satisfaction which is so critical in a post-Covid world.

Better CX.

More Efficient.

Reduce Cost.

6 Things Contact Centers Should do

From this perspective, contact centers should pay close attention to the following aspects of digital transformation:

1. AI and Machine Learning

Perhaps no other technology is as crucial to digital transformation as AI. Machine learning is widely used for automating processes and route interactions across the call center. However, what is less widely implemented is the ability of ML tools to provide real-time analytics for decision-making that can improve CX.

- Well-trained and optimized machine learning models can provide a vast amount of intelligence on consumer behavior, patterns, and identity that can be used to make smart decisions about authentication, personalization, and call routing.

- AI is fundamental to chatbots, analytics, and workflow optimization that makes the technology environment work in an efficient and scalable fashion.

- Different forms of AI such as machine learning, natural language, ASR, RPA, and deep learning are key to customer identification and authentication, speech, and intent recognition as well as managing customer interactions in an omnichannel environment.

- Quality of AI models, datasets, learning environments, and fairness are vital to ensure that the technology platforms driving the digital transformation are effective and accurate.

2. Voice Biometrics

Deep Neural Network-based voice biometrics are an integral part of a cohesive, omnichannel, and customer-focused contact center.- A passive, seamless, and frictionless voice biometric platform can allow for the identification and authentication of customers not just on the phone but on mobile apps, chatbots, and IoT devices also.

- Voice biometrics can also protect call centers against malicious actors using synthetic voices, deepfakes, or replay attacks.

- Voice-based interactions can replace time-consuming, manual workflows.

- Contactless voice interactions can enhance customer satisfaction by allowing them to authenticate themselves in a variety of circumstances where other, active methods are not helpful (e.g. driving).

3. Superior CX through Multi-factor Authentication

Identity verification and authentication of customers are the backbones of the contact center. In a digital transformation process, authentication methods and policies assume even more importance in protecting calls and transactions.

- Relying on a single factor for authentication (KBA, OTP) is less secure and more prone to errors. Leveraging multiple, synergistic factors (ANI, voice, behavior, device, risk) can increase your confidence in the authentication process while providing more options to customers to identify themselves across multiple channels.

- Better authentication that removes KBAs, call handle times can contribute to improved customer satisfaction and better Net Promoter Scores (NPS).

- The ability to continuously authenticate customers across channels, from telco network to agent’s leg and even between agent transfers can further streamline the authentication process and improve CX.

4. Self-Service

Increased ability for consumers to get more self-service through multiple channels is the lynchpin of contact center digital transformation. Better self-service with more protection not only helps with customer satisfaction but also contributes to cost reduction and better management of call center capacity.

- The number of customer interactions (via phone channel or digital) has increased post-Covid. In view of limited agent capacity (headcount, hours, and efficiency), this has increased the burden on agents while creating longer queues and wait times. Offering consumers more ability to self-serve can alleviate the agent burden and improve wait times.

- Interactive Voice Response (IVR) is a key component of the contact center and an underutilized aspect of the digital transformation. As the first point of contact for many consumers, the IVR has the potential to offer much more service than just a point of frustration before the caller punches out to the agent. Containing more calls in the IVR through better authentication and risk monitoring can improve call center efficiency and reduce costs of agent call handling.

5. Personalization

Closely tied to better authentication and self-service is the ability to offer a more personalized call experience to the consumers. This personalization can be provided in the form of an initial greeting recognizing the identity of the caller or even provide a customized menu of services based on previous behavior patterns.

- Tools like ANI validation and spoof detection can be used to analyze the risk of incoming calls. Low-risk calls in particular can be offered a less intrusive authentication experience such as with fewer KBAs or without OTPs. This would ensure a more satisfactory authentication experience for a large volume of calls.

- Authentication experience can be personalized for callers based on the variance of risk and enrollment profiles. This could range from zero KBAs for highly trusted callers with enrolled profiles and low-risk signals to more stepped-up authentication policies for higher-risk callers.

- IVR menus, agent greetings, and even the ability to conduct business in the IVR can be personalized to callers based on their enrollment profiles, authentication feedback, and the call center’s authentication policies.

At the core of every digital transformation process there is a question of whether it can keep out fraudsters and prevent data breaches and identity thefts that could lead not only to monetary loss but also to loss of brand reputation. Protecting the call center from fraudsters enables all of the above processes and provides sufficient confidence to be able to serve genuine customers.

- Protecting the entire call center from pre-ring to IVR and then to agents as well as digital channels is crucial. The risk of fraud changes during various stages of the call and every piece of information about the call can come into play to decide the risk it poses to the call center. This could include the risk of the caller ID, anomalous signals from the carrier, suspicious behavior such as multiple calls placed relative to a single account, spoofed caller IDs, synthetic voices, attempts to change email addresses, and so on. Every piece of data counts and needs to be conveyed to the agents and/or fraud investigators in real-time. Even more than the discrete data points, the ability to put all of them together into a holistic picture of call risk and account risk is even more critical.

- Vulnerable channels such as the IVR need more protection. A Forrester Consulting study commissioned by Pindrop, “Reducing IVR Fraud Through Advanced Account Risk Capabilities”, found that 76% of fraudsters are using the IVR for account mining or reconnaissance. Fraudsters employ brute force tactics to extract account information and identity data out of the IVR and leverage that data across other channels to commit fraud. These attempts are not limited to the phone channel or even the digital channels but extend to branches, kiosks, and other places that otherwise may not be aware of the risk and the exposure. Protecting the IVR not only helps to stop the fraud but also paves the way to increase confidence in the good callers and offer them more personalized services.

- An underappreciated value of fraud detection tools is their ability to feed into and strengthen authentication systems via risk assessment. Leveraging risk signals as an input for cross-channel authentication opens up a whole new avenue to validate callers without enrollments, thus saving cost and time. Risk signals can also be used to step-up authentication on high-risk calls or to combine risk signals from one channel with auth feedback from others and vice versa.

How can Pindrop help?

VeriCall® Technology analyzes call metadata with machine learning to confirm when a call is coming from the device that owns the number. The technology can complete analysis in under 60 milliseconds and delivers a risk score to the IVR using an API. Contact centers can step down active authentication requirements for calls scored “Green.” On average, over 75% of calls analyzed receive a green score. Stepping down active authentication can save time and money for the business while improving the customer experience. VeriCall® technology can also detect call spoofing to help protect against bad actors.

Pindrop Passport evaluates call center interactions in real-time to passively authenticate legitimate customers. Passport runs in the background of every call, combining patented Phoneprinting® technology with proprietary Deep Voice™ biometrics to determine if a caller has the right device, voice, and behavior to access an account. Whether callers use voice or touch-tone interactions within the IVR or opt to speak to an agent, Pindrop credentials follow customers across the lifecycle of each call.

Pindrop® Protect is a multifactor, real-time, fraud prevention solution that analyzes calls into the contact center for voice, device, and behavior to find up to 80% of phone channel fraud, predict future fraud 60 days in advance, provide a complete cross-channel view of fraud, reduce costs and review rates, and protect the company against attacks.

Pindrop has helped financial institutions to advance their digital transformation initiatives with our authentication and fraud detection solutions. Download the FNBO and UCBI case studies to get a better understanding of how Pindrop contributed to their CX and fraud detection goals.