This is the original report updated on July 15th 2020 to include data and insights from the second phase of COVID-19. The initial report covered the period of 1 Jan to Apr 20th and this version extends the coverage from Apr 20th to Jun 22.

A short history of how the pandemic has unfolded – how contact centers have faired and how fraudsters have taken advantage

Each day brings a new wave of COVID-19 headlines, most of them unsettling. While many are looking forward to the day when they can return to normal life, the reality is one of upheaval: a hastily implemented work from home policy, financial instability and an almost overnight change in consumer behavior.

Business continuity plans have been pressure tested beyond their authors expectations, with the effects felt in operations, security, and customer experience. As a critical customer interface, contact centers have felt the effects directly, regardless of geography and industry. The global pandemic hit this critical function, and many were left scrambling to keep their operations running, customer service levels up, and their customer data safe. Only today are we starting to see some early indications of a return to normal patterns – but this is far from over.

Pindrop, an enterprise voice security company, works with eight of the top 10 banks, three of the top five brokerages, and five of the top seven life insurers. We exist to help contact centers defend against fraud, improve their CX, and drive operational efficiency through both security and authentication solutions.

In the first edition of the report, we collected data, observations and learnings from systems and customers to outline five insights on how COVID-19 has impacted contact centers, and how they should protect themselves against what’s coming next to manage through these uncertain times. In this current update we continue to evaluate these trends and provide updated observations as the situation continues to evolve.

INSIGHT 1: THE EARLY SYMPTOM – BROKERAGES AND CALL VOLUME

The stock market was a leading indicator of the severity of the COVID-19 crisis. In late February, it was business as usual across most of the U.S., but the S&P 500 fell almost 10% in the week of February 24. Some brokerages were already seeing a double digit increase in call volumes compared to normal as customers tried to manage their portfolios amidst the chaos. By the week of March 9th, overall call volumes were up significantly and have continued to rise as the COVID-19 crisis continues to impact different parts of the economy.

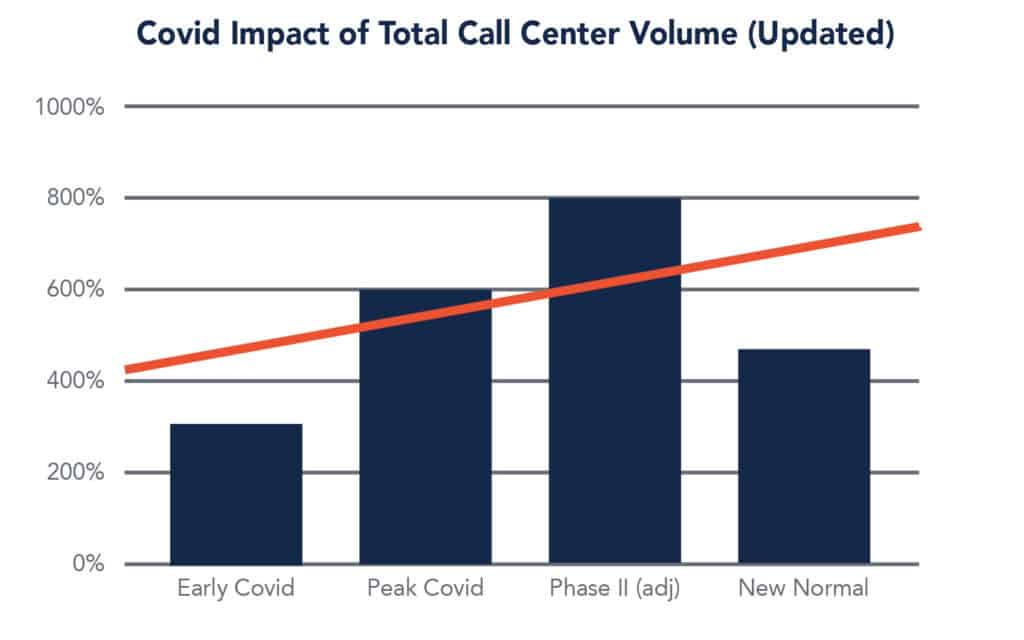

In the early stages of the pandemic overall call volume to the contact center climbed 300% in just days. By the later stages we are seeing enterprise contact center call volumes jump over 800% from normal levels.

As Covid cases peaked in late March and beginning of April, there was also a simultaneous spike in unemployment claims amidst concerns about an economic slowdown. Some of these factors may have driven an increase in the call volume through the Peak Covid period and into subsequent Phase II as stimulus checks went out. As some of these factors started to trend downwards in the new normal period from May onwards, call centers experienced a decline in call center volumes which are, nonetheless, still higher than the pre-Covid levels.

INSIGHT 2: THE WAVE HITS IN EARNEST

In the first half of March, the scale of the crisis became painfully apparent. People hastily shifted to working from home, schools closed and millions of people became jobless. Unsurprisingly, the volume of calls to call centers jumped as physical locations closed – an increase of as much as 600% in certain instances. Individuals were looking to protect their financial well-being by increasing credit card limits, delaying payments on loans and, in some cases, taking advantage of low interest rates by refinancing mortgages. These were tasks that couldn’t be trusted or performed via an app or web portal and required interaction with a live agent.

As if this wasn’t enough of a shock to the system, the volume increase hit just as contact centers had to fundamentally overhaul operations to meet social distancing requirements. Most contact centers were unprepared for the magnitude of the shift to work from home and scrambled to take steps to set their agents up with technology and secure VoIP infrastructure at home. Agents and analysts faced productivity issues as environmental changes and technology constraints took their toll. Meanwhile, global contact centers in locations such as India and Philippines were facing all the same issues – there was no slack in global supply.

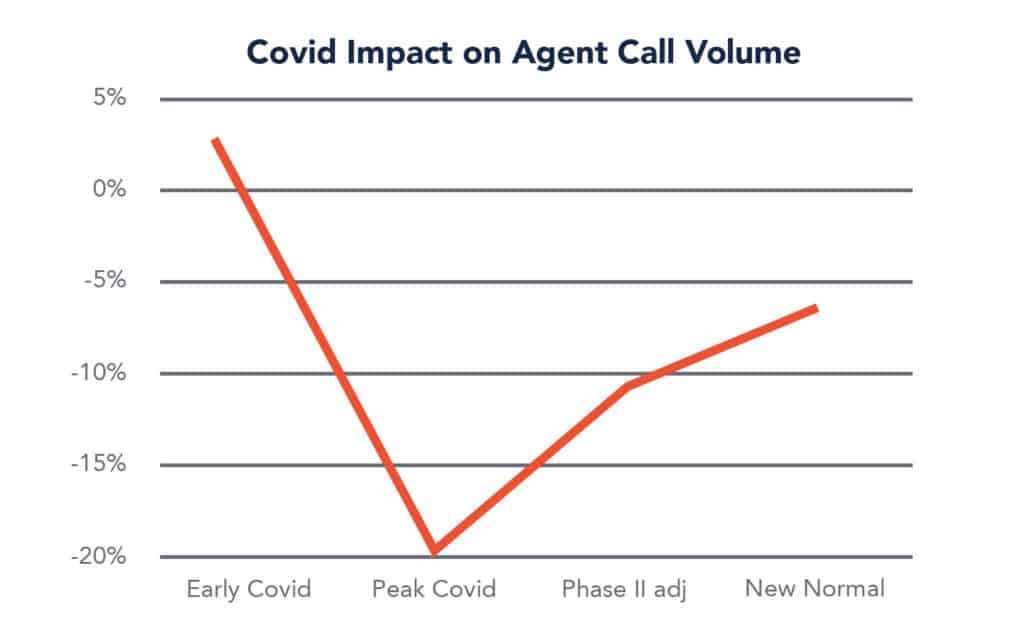

One of the major impacts of these changes in infrastructure on contact center operations was the call volume capacity that agents could handle. In the early days of COVID-19 in the U.S., agents were able to actually increase capacity slightly over pre-COVID levels. As teams began to change operations agent call capacity dropped by 20%. Tireless work on the part of operations teams and agents had restored nearly 50% of lost capacity by the beginning of May. Since that time contact centers have been successful in recapturing lost efficiency through several means including improved work from home productivity and more streamlined technology, processes and operations. Agent call capacity is still 7.6% lower than pre-Covid levels. Contact centers are likely to experience a new normal of call handling capacity which is higher than the pre-Covid levels as we expect the new wave of Covid cases and resulting restrictions and branch closures to affect call volumes. However contact centers are now more confident of and better prepared to handle systemic shocks than they were at the start of the pandemic.

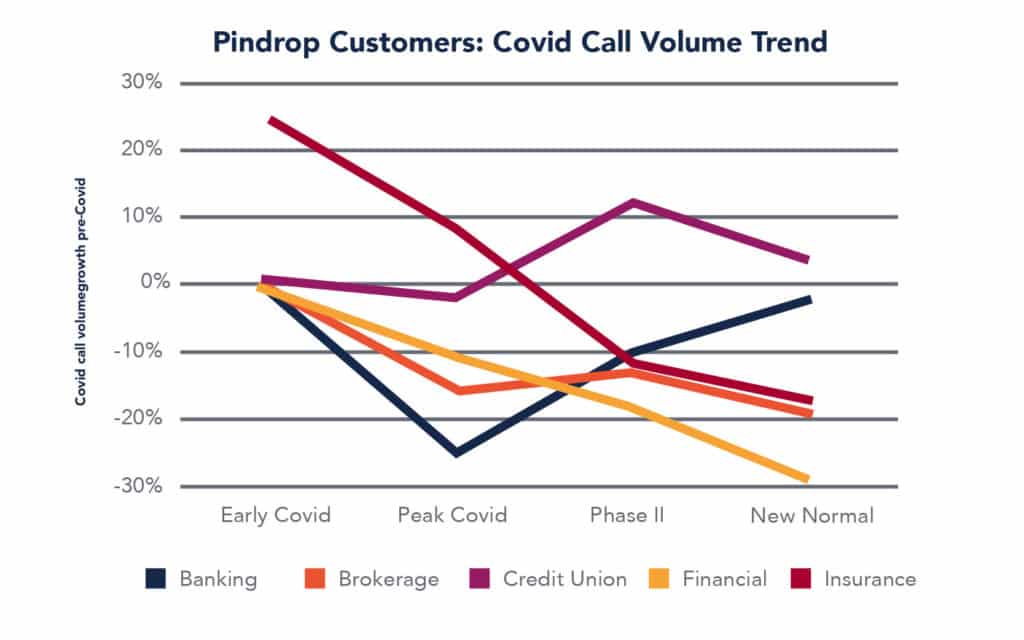

These trends vary by industry sector but tell a similar story with the notable exception of credit unions who have managed to buck the trend initially but have returned back to normal capacity. On the other hand, the banking sector has shown a consistent improvement in agent productivity after the steep initial drop off.

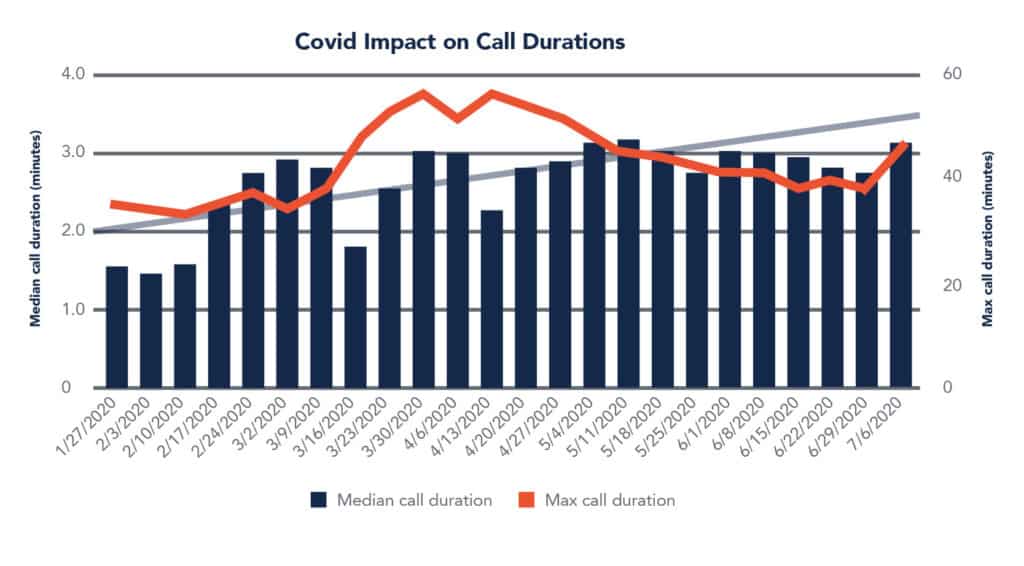

The impact of massive overall call volume increases and reduced agent capacity ultimately lands with a negative impact for callers. The median call duration into the contact center pre-COVID was about a minute and a half. That number has doubled to 3 minutes as a result of volume and capacity and has continued to stay at that level post the Peak Covid period. More alarming is the increase in maximum call duration which peaked at 55 minutes (62% increase from pre-covid period) due to a combination of factors including a spike in call volume from stimulus checks, increasing unemployment insurance claims as well as increased concern about their finances during this period. After the initial peak of Covid, as some of the mortgage forbearance and unemployment strains mildly eased up, there was an associated decline in max call duration. However this has started to inch up again which could create aggravation for consumers and add to overall stress for the population.

This increased call duration creates an unsatisfactory experience for customers, obliterates call center metrics, and likely hides fraudulent and reconnaissance activity. The increased call volume and length of call also means a likely increase in fraud cases and a case backlog as a result of shrinking capacity.

[optin-monster slug=”veowvgbyv2iwn47twt5u”]

INSIGHT 3: FRAUDSTERS SMELL THE OPPORTUNITY

In early March, governments across the world began warning consumers of a sudden uptick in scams most likely driven by current and assumed-future economic conditions. Phishing scams that would evolve into fraudulent activity across banking, financial services, insurance and other verticals. The fraudsters would adapt their social engineering appeals to reflect current events and play on anxieties. Taking many standard techniques and simply adding a dose of newsfeed.

We have spoken to several Pindrop clients who have advised they are seeing fraudsters exploiting the current pandemic. So far, we’ve heard about some of the following cases:

- The fraudster stated they were in Spain under lockdown and needed to get more funds out of their account

- The fraudster claimed to be a parent who is moving back in with a child to shelter in place during the required “shelter in place” orders and needs moving funds

- The caller claimed to be a caregiver attempting to help a COVID patient on a respirator in paying their bills and needs access to the online portal

- Fraudsters contacted seniors, telling them they need a new Medicare card for COVID-19 coverage and protections – then asked for their social security number.

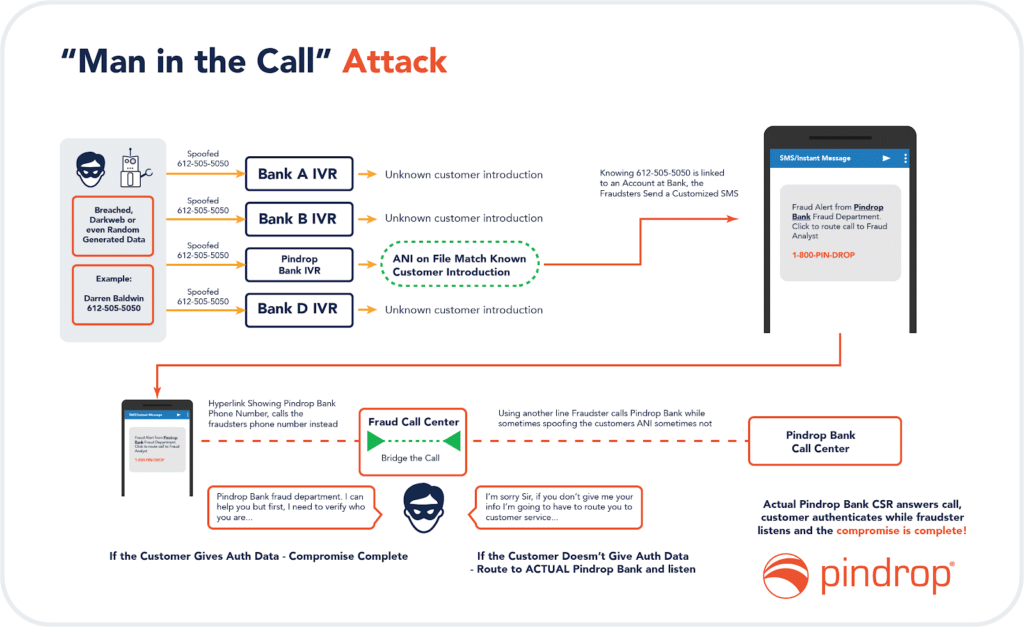

Additionally we are hearing more about ‘Man in the Call’ attacks using COVID as the catalyst. The illustration below outlines the tactic:

During the Covid phase several call centers had to relax controls in order to expedite customer service and reduce wait times. Normally this would have made it easier for fraudsters to target call centers. However, the fraudsters were thwarted in their attempts by long call wait times, agent capacity disruptions and call terminations. At the same time though, fraudsters were able to spend more time in the IVR and were able to gather a lot of data through phishing, reconnaissance as well as several more sophisticated strategies using fake credit card numbers, spoof cards. These same fraudsters are likely biding their time and are looking for a window of opportunity to put all this acquired information to use, not just in the call center but in the online channels as well. This could lead to an increase in expected fraud attempts in the next few months especially as fraudsters target high value accounts for bigger payoffs. Fraud prevention teams and call center security management should be aiming to increase the level of control and to institute advanced, cross channel fraud detection tools and techniques to stop these attacks.

A growing number of customers in the finance and insurance sectors have experienced an increase in fraudulent activity during the COVID-19 period. Interestingly the increase in call durations experienced across contact centers may also be affecting the ability of fraudsters as well which could cause the spike in fraudulent activity to be suppressed before it reaches the agent.

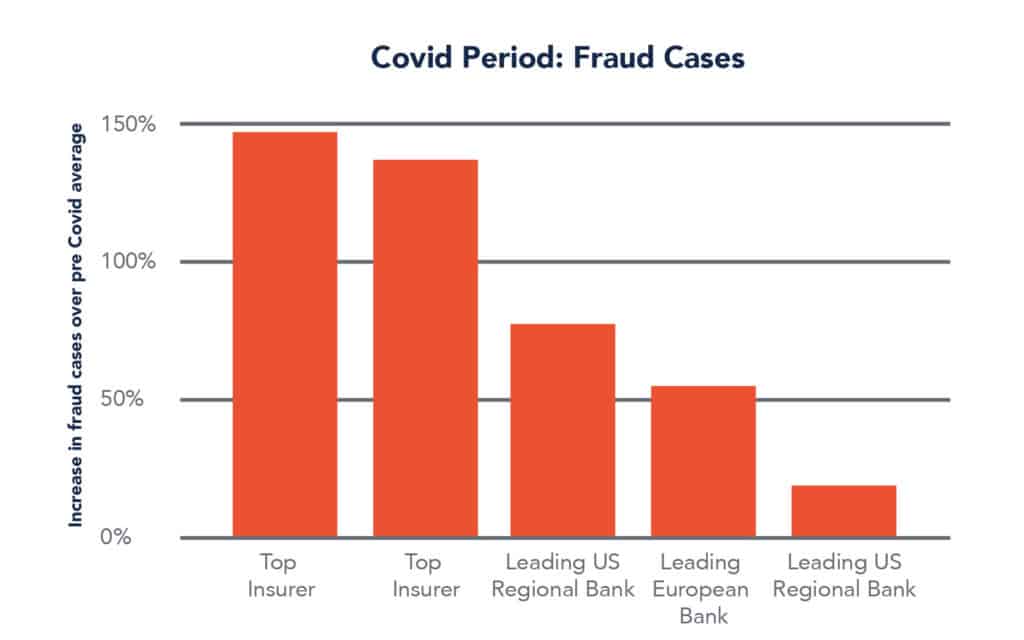

Some clients saw fraud jump by as much as 150% when compared to historical levels, and a significant number of clients saw, at minimum, a double digit increase. More than half of our clients saw an increase in fraud cases during the initial stages or during the peak phases of COVID activity. Counterintuitively, this fraud didn’t hit the entire industry simultaneously. Instead, it went institution by institution, with spikes emerging in one bank before moving on to another. This could suggest that the fraud was coordinated and that it was based on research and reconnaissance carried out months before – fraudsters were simply waiting for the right moment to go after the vulnerable accounts.

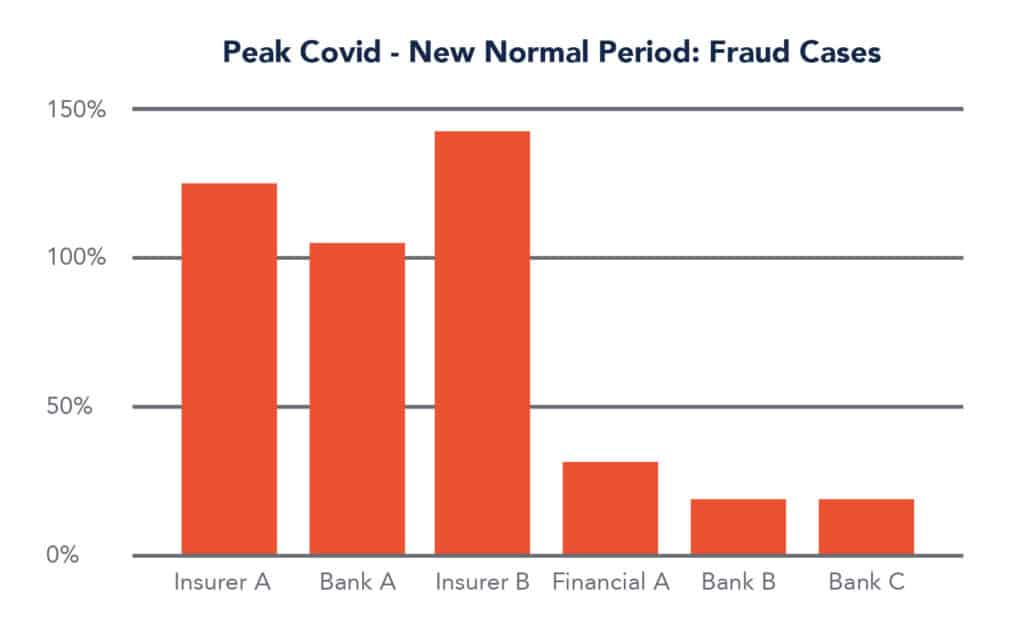

Some of our clients also saw double and triple digit increases in fraud activity after the Peak Covid period leading up to the current period. More than half of our clients saw the same or more amount of fraud cases after Covid had peaked and the new normal had started to emerge. Some of the fraud activity has also moved from Banking sector to the Insurance sector, which has experienced increased fraud during the post Covid period

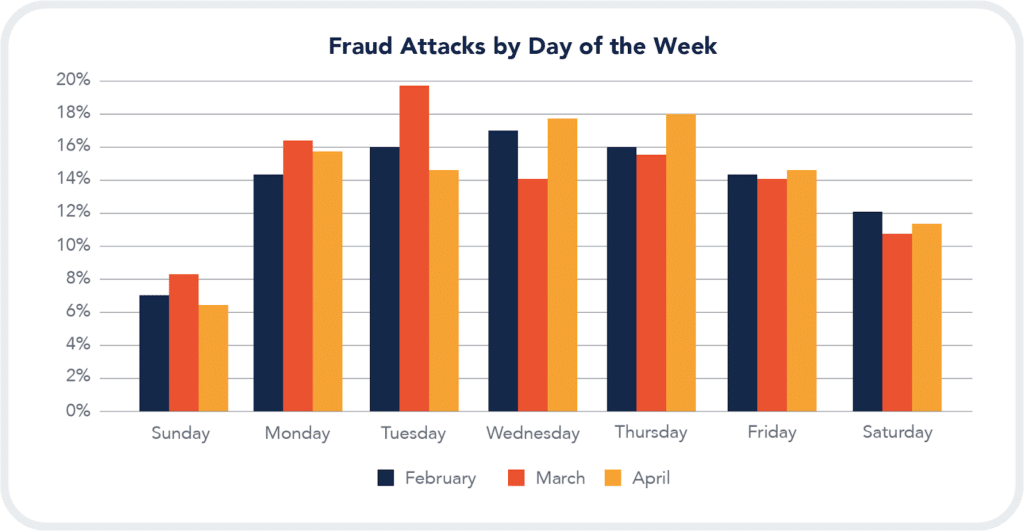

While fraudsters are changing the message in their tactics and ramping their activity they are sticking to some consistent trends. We have not observed changes in the timing of fraud attacks based on the day of week over the 3 month period.

Fraudsters will work hard to adapt to any crisis and deploy proven tactics to steal. Contact centers need to be especially vigilant during these times and deploy technology that will help the agents identify the fraudsters in the crowds quickly and easily.

[optin-monster slug=”s82dyfpsso3ly8pcnos0″]

INSIGHT 4: A NEW WAVE FOLLOWS THE GOVERNMENT RESPONSE

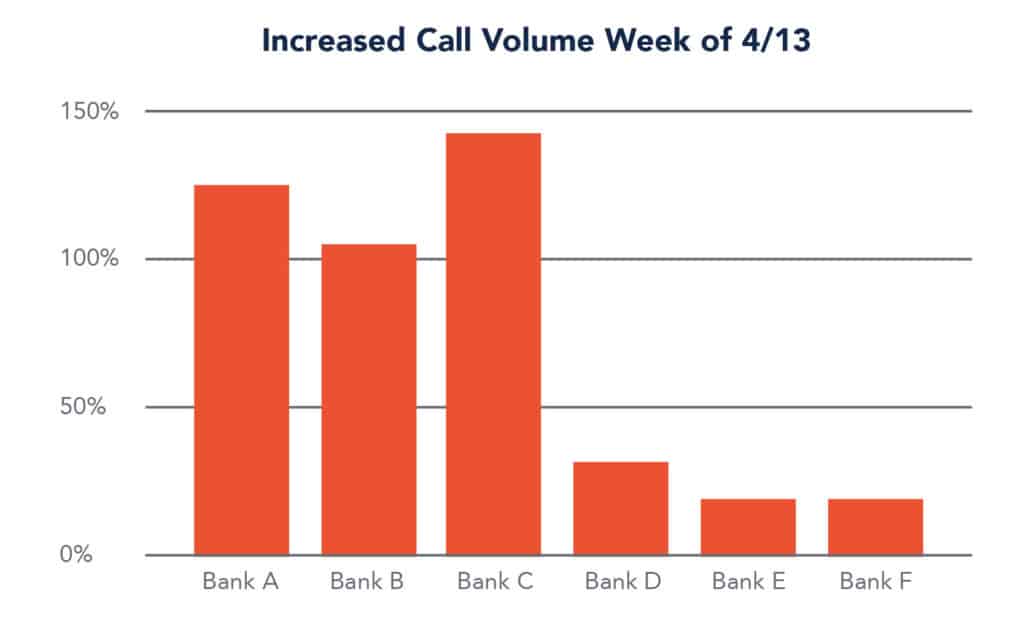

In the midst of surging unemployment, the federal government has passed more than $2 trillion of emergency measures. At least two portions of the stimulus – checks to individuals making less than $70,000 a year and loans to small businesses – were administered via banks. It’s no surprise, then, that the second half of April saw another tsunami of call volume. Many banks saw their volume rise 100%+ as individuals called to check on the status of their relief.

One large bank saw a spike of two times their weekly pre-COVID call volume in just one day, April 15th, related to the status of stimulus funds being deposited into customer accounts. Most of these callers were first time callers pointing to future needs for passive authentication. A broader sample of customers showed increases from 16% to 144% for just that one week.

This additional increase in call volumes into the contact center continues to put pressure on already stretched resources and systems.

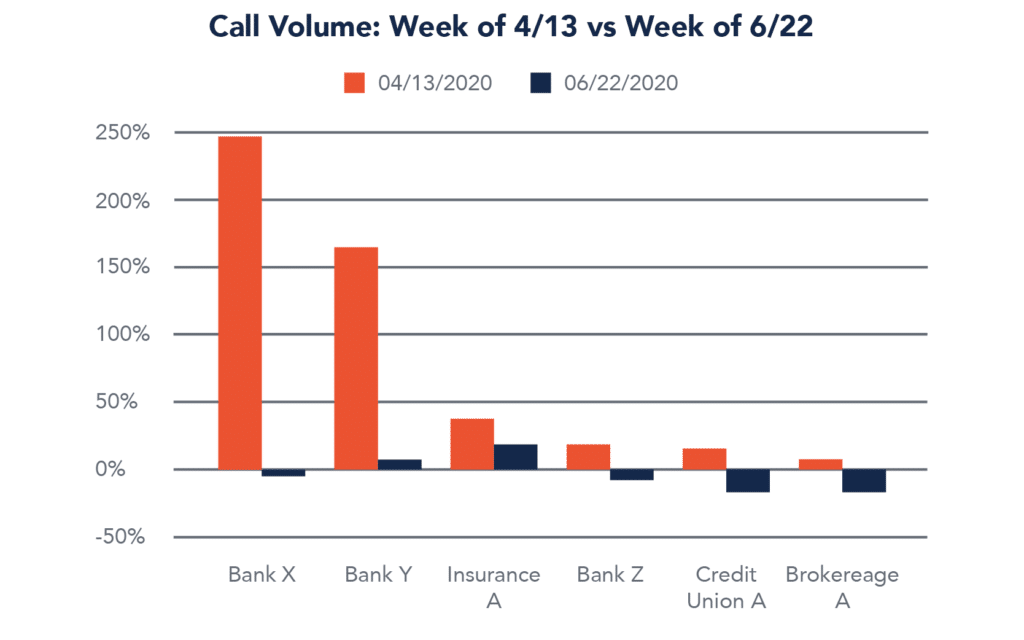

A cross section of our clients shows that call volumes into the contact center have eased in the post Peak Covid period. Where some customers sawan increase in call volume, others experienced a slight decline compared to the pre Covid levels. Some of the larger macro-economic trends including unemployment rates, mortgage forbearance as well as lack of fresh stimulus payments may have contributed to a more stable call volume which is closer to pre-Covid periods.

INSIGHT 5: LOCKDOWNS EASE AND THE AUTHENTICATION NECESSITY IS CLEARER THAN EVER

At this point, many in the industry have adapted to the new normal as we had predicted in our previous blog. Agents are set up at home and are mostly capable of handling the day-to-day volume and defending against fraud tactics. They need to prepare for the next wave of disruption, as states and cities slowly ease lockdown measures and individuals slowly begin to move around more freely and; hopefully, jobs begin to return.

It is vital that banks and other institutions learn the lessons from the previous wave. At this stage, they’ve logged minutes if not hours of time with their customers. When the customers call next, this should translate into rapid authentication to cut hold times and time spent in the IVR. The pandemic has put massive strain on consumers – they shouldn’t have to deal with more stress when they call their bank or insurance company. Crucially, this type of authentication has to be passive and multi-factor. As call durations continue to be long for the foreseeable future, it’s important that the consumer and agent’s time is spent on solving actual problems rather than on KBAs or active enrollment procedures. While at the same time call centers need to ensure they do not enroll fraudsters who are constantly targeting contact center weaknesses. Therefore a multi-factor, risk based authentication solution that enrolls passively would help streamline the authentication process and improve customer experience.

CONCLUSION

It’s important in all this to remember that there is more to the reality of a contact center than the numbers. Call volumes only measure the number of calls that make it to an agent; fraud numbers only measure fraud that was flagged by overworked fraud analysts. As we think about the new normal for the country, the financial sector should consider what the crisis has unveiled about its contact center infrastructure. Customers need assurance that they are secure and can access help from an institution that knows them. Stay tuned to Pindrop Pulse for further advice on how to handle COVID-19 in the weeks and months ahead.

ABOUT PINDROP – Pindrop is a leader in contact center security and provides advanced solutions for authentication and fraud detection to some of the world’s largest contact centers. We serve fortune 500 companies across the financial, insurance, banking, and retail industries; Pindrop offers a full suite of fraud and authentication solutions. Solutions that enable contact centers to ensure customer experience, expand capacity, and mitigate fraud loss by quickly authenticating genuine users, reducing wait times, and providing real-time alerts and case management tools to detect and minimize potential fraud.