While the financial fallout from COVID-19 may have sent the US economy into a pandemic-induced hibernation in 2020, Americans woke this Spring to low interest rates, lower unemployment, new stimulus checks, and eventually more widely-accessible vaccinations. This may explain why consumer confidence, borrowing, and spending are trending up. Meanwhile, gains in the stock market are encouraging many Americans to invest (some for the first time), while others are taking the opportunity to relocate, renovate, or refinance. In short, signs suggest that we are ‘back in business.’

For the contact center, the implications should be an encouraging sign for a financially healthy 2021. But, after over a year of volatility and uncertainty, it should also be a forewarning to thoughtfully and adequately prepare for what may lie ahead. To help organizations identify the trends and shifts to be accounted for, Next Caller commissioned a study conducted by Beantown Media Ventures in June 2021 that asked 1,000 consumers over the age of 18 and living across the United States about how their banking behaviors and expectations evolved, and about the importance that the customer experience had in choosing their bank. Here’s what was uncovered:

Analyzing the Surge in Bank Activity

Nearly 60% of consumers surveyed reported that they are more interested in saving, investing, or getting a loan today than they were just one year ago. Interestingly, that number jumped even higher for younger generations, with 74% of Gen Z and Millennials surveyed reporting the same.

These results demonstrate that regional banks and credit unions have an opportunity to increase business with current customers, but also a chance to win business from a younger demographic that has been traditionally difficult to capture. However, with the proper understanding of the needs and expectations that this cohort holds, credit unions and regional banks can position themselves as both an attractive alternative or supplement for the elusive cohort, while continuing to foster relationships across the rest of the generational spectrum.

Despite some encouraging trends, not everyone is benefiting from the recent economic conditions and many are actually in a worse financial situation than before the crisis. When combined with those calling to capitalize on exciting new opportunities, callers that are looking for help managing their circumstances may also be contributing to the overall rise in call traffic to contact centers. Spikes in call traffic can challenge contact center teams and the processes and systems in place to keep the balance between a good call experience and operational security.

Meeting Digital Demands

Quick and easy online or mobile banking experiences have almost become table stakes to delivering on customer service expectations. However, there can be a digital divide between the digital experiences of regional banks and credit unions and their more resourced national competitors. This innovation lag may contribute to the difficulty that regional banks and credit unions might face in trying to capture the younger generation who prioritize digital-friendly interactions.

Younger generations (millennials and Gen Z) are attuned to what “good” and “bad” digital customer experiences look and feel like, often because they have a lifetime of experience with them. As such, these individuals appreciate, and likely place a premium on, a digital-friendly approach when it comes to banking. Millennials surveyed were almost twice as likely (41%) than Gen X (23%) and Baby Boomers (24%) surveyed to say that “a better digital/mobile experience” was influential in them choosing their banks. The time is now for regional banks and credit unions to embrace digital-friendly experiences in order to attract and keep the interest of younger customers

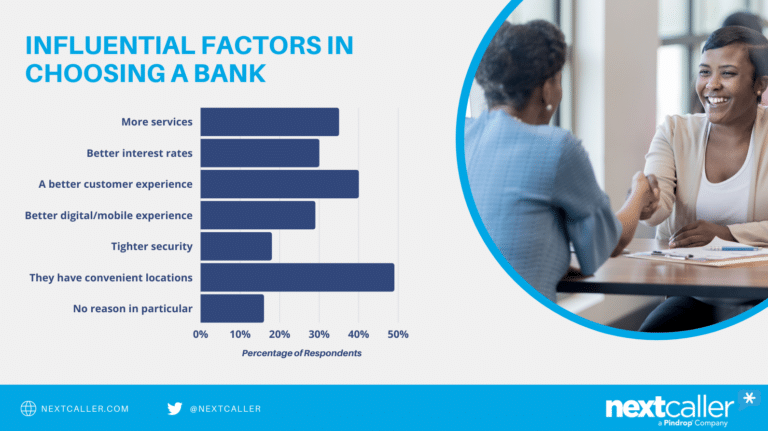

Of course, it’s not just our younger generations that care about Customer Experience. 40% of consumers surveyed said that customer experience was an influential factor in choosing their bank. Few areas in life can bring as much stress, anxiety, or even excitement as finances. And given the volatile backdrop of the past year, it is reasonable to assume that the urgency around financial matters across the age spectrum is likely to have grown. In short, now may be the perfect time to make for a good impression. But, making a good impression can be challenging if your business cannot authenticate customers when they call. The extent to which a contact center can streamline authentication by making it passive, and predictive could be the determining factor in whether the caller stays a long-term customer.

Balancing Service & Security in the Call Center

A combined 61% of consumers surveyed who bank with a regional bank or credit union said that when they call they prefer to “talk to a human being for most things” (44%) or that they “want to talk to a human no matter what” (17%). This places the onus on contact centers and their teams to deliver consistent, and consistently good service, even when stretched thin.

This is a challenge under any circumstance, but in an environment where there is less room for error, it can be an even more daunting prospect. Over 30% of consumers we surveyed reported that they would switch banks after 1-2 poor customer service experiences.

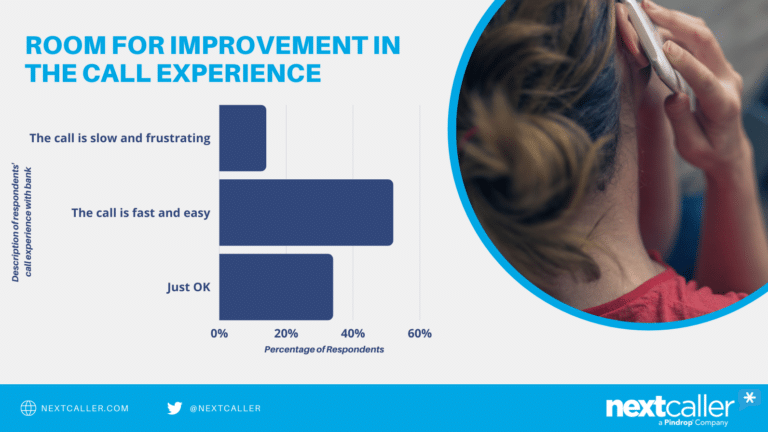

Further illustrating the importance of service for bank customers today, is the fact that nearly 40% of those surveyed switched banks due to a bad customer service experience. To reduce any churn, call centers need to handle customers’ needs with empathy and without friction. With 48% of consumers surveyed saying their experiences when calling their bank is “just OK” or “slow and frustrating,” there is room to improve–or differentiate from those that don’t.

But where does this friction come from? While there are many things that can go awry during a customer service interaction, the cause of frustration can come down to traditional methods of authentication, such as knowledge-based questions and one-time passcodes. These methods were created to stop criminals, but they can end up exasperating customers.

Additionally, fraudsters who have had ample opportunity to secure personal information over the past year can be better than customers at answering KBA questions. Over time, these methods have lost effectiveness as a primary tool in keeping customers safe.

Achieving the right balance between service and helping protect a business from fraud in the call center falls to seamlessly integrated digital tools such as ANI Validation, paired with ANI Matching capabilities that can quickly link callers to their accounts. Many customers may now expect customer service reps to know their purchase history and contact information as soon as they start speaking to one another. With these passive tools, contact center teams can increase the number of customers who experience a more seamless authentication process, without rolling the red carpet out to impersonators. The resulting efficiencies can also help reduce agent caseload and cost per call by saving handle time.

Perhaps eager to make up for lost time, consumers might also be actively shopping for the financial institutions that can best enable their plans. And with so many choices, they may not be likely to compromise. Thus, an opportunity is forming for community banks and local credit unions to stand out in an otherwise crowded field. Earning business can hinge on delivering a personalized, frictionless experience–and every phone call is a new first impression.